Below are my short comments about some of the most important political economists and why I believe each is important today, typically focusing on neglected aspects of their work that are no longer taught or even remembered by most economists. Economics has lost its way in part because it has severely discouraged the conceptual innovation it so sorely needs. Critical reading of political economists of the past can recover concepts and ways of thinking that are lost to modern economics and thus expand how we think about what the economy is and how it works. This list is not exhaustive. It has a heavy bias toward the nineteenth century because there has been surprisingly little useful conceptual innovation since then. I may add to this list from time to time. It is alphabetical rather than in any priority order.

Walter Bagehot (1826-1877)

Economics today is an exercise in propaganda, not science, so it is not surprising that many crucial aspects of the real economy are neglected. Among these are the issuance of short-term credit and the markets in which circulating credit instruments (bills) are traded. The vast significance of short-term credit is not taught by economists because it does not fit their simplistic story of what an economy is and how it functions. Even advanced courses in finance neglect the significance of short-term credit, mostly assuming it is an equilibrium market in the background doing nothing noteworthy. In fact, short-term credit is the canary in the coal mine; it is the locus of every financial crash. It deserves vastly more attention than it gets. Bagehot’s classic “Lombard Street” is readable introduction to why short-term credit is the lifeblood of the economy. Although written almost a century and a half ago, it remains quite relevant today, in part because modern finance and economics largely ignore what it teaches. Bagehot treats one major part of the totality of short-term credit: bill issuances and subsequent trading. Short-term credit also includes bilateral lines of credit, but bills are the primary circulating instrument. They are to short-term credit what bonds are to long-term credit. I use “bill” as the generic term for circulating short-term credit, although a plethora of names in actual use obscures the similarity of all such discounted fixed-term financial products. Wikipedia

Economics today is an exercise in propaganda, not science, so it is not surprising that many crucial aspects of the real economy are neglected. Among these are the issuance of short-term credit and the markets in which circulating credit instruments (bills) are traded. The vast significance of short-term credit is not taught by economists because it does not fit their simplistic story of what an economy is and how it functions. Even advanced courses in finance neglect the significance of short-term credit, mostly assuming it is an equilibrium market in the background doing nothing noteworthy. In fact, short-term credit is the canary in the coal mine; it is the locus of every financial crash. It deserves vastly more attention than it gets. Bagehot’s classic “Lombard Street” is readable introduction to why short-term credit is the lifeblood of the economy. Although written almost a century and a half ago, it remains quite relevant today, in part because modern finance and economics largely ignore what it teaches. Bagehot treats one major part of the totality of short-term credit: bill issuances and subsequent trading. Short-term credit also includes bilateral lines of credit, but bills are the primary circulating instrument. They are to short-term credit what bonds are to long-term credit. I use “bill” as the generic term for circulating short-term credit, although a plethora of names in actual use obscures the similarity of all such discounted fixed-term financial products. Wikipedia

Irving Fisher – (1867 -1947)

Like so many important economists, Fisher is generally remembered today for his wrong-headed contributions and nearly forgotten (at least in textbooks) for his most important one. The Fisher equation (actual interest rate = real inflation rate plus the rate of inflation) is in every introductory macroeconomics textbook. This looks like a simple accounting identity, but disguises numerous errors. This and his other arguments about the determination of real interest rates have misdirected attention from the actual determinant of interest rates—the strategic action of creditors—and instead argued that “the” real (singular) interest rate is determined by the marginal productivity of physical (MPP) capital, which remains the orthodoxy today, despite being false logically and empirically (like most concepts of textbook economics). There are so many conceptual errors in this formulation it is difficult even to list them all here, let alone explain them. Here is an incomplete list: MPP of capital is a logically inconsistent concept that is also not measurable for many industrial processes; MPP of capital is never and can never be equalized across firms in a competitive economy because of differential depreciation, debt leverage, and pricing power among firms; thus the average profit rate is the result of many factors other than the MPP of capital; most loans are not for the purchase of physical capital anyway, so there is no reason the average profit rate on physical capital should govern “the” interest rate; and “the” inflation rate is usually taken as the consumer price index, but this is nonsensical since investors and creditors, not consumers, are making the big decisions about lending and borrowing and these mostly rich people and institutions consider relative asset prices, not consumer price inflation, as the appropriate discount rate. My way of doing political economy focuses on the real struggles between debtors and creditors over interest payments and loan terms as the requisite framework to understand the credit cycle and consequently interest rate volatility. On the other hand, Fisher’s book on debt deflation, written during the depths of the Great Depression, is useful up to a point. He lacks appreciation of private strategy in the financial realm, but at least he sees a problem often neglected by economists: that deflation tends to bankrupt many firms and governments as their income falls but their debt does not. Deflation favors creditors and squeezes debtors. Joan Robinson provides a worthy corrective to Fisher. Wikipedia

Like so many important economists, Fisher is generally remembered today for his wrong-headed contributions and nearly forgotten (at least in textbooks) for his most important one. The Fisher equation (actual interest rate = real inflation rate plus the rate of inflation) is in every introductory macroeconomics textbook. This looks like a simple accounting identity, but disguises numerous errors. This and his other arguments about the determination of real interest rates have misdirected attention from the actual determinant of interest rates—the strategic action of creditors—and instead argued that “the” real (singular) interest rate is determined by the marginal productivity of physical (MPP) capital, which remains the orthodoxy today, despite being false logically and empirically (like most concepts of textbook economics). There are so many conceptual errors in this formulation it is difficult even to list them all here, let alone explain them. Here is an incomplete list: MPP of capital is a logically inconsistent concept that is also not measurable for many industrial processes; MPP of capital is never and can never be equalized across firms in a competitive economy because of differential depreciation, debt leverage, and pricing power among firms; thus the average profit rate is the result of many factors other than the MPP of capital; most loans are not for the purchase of physical capital anyway, so there is no reason the average profit rate on physical capital should govern “the” interest rate; and “the” inflation rate is usually taken as the consumer price index, but this is nonsensical since investors and creditors, not consumers, are making the big decisions about lending and borrowing and these mostly rich people and institutions consider relative asset prices, not consumer price inflation, as the appropriate discount rate. My way of doing political economy focuses on the real struggles between debtors and creditors over interest payments and loan terms as the requisite framework to understand the credit cycle and consequently interest rate volatility. On the other hand, Fisher’s book on debt deflation, written during the depths of the Great Depression, is useful up to a point. He lacks appreciation of private strategy in the financial realm, but at least he sees a problem often neglected by economists: that deflation tends to bankrupt many firms and governments as their income falls but their debt does not. Deflation favors creditors and squeezes debtors. Joan Robinson provides a worthy corrective to Fisher. Wikipedia

Rudolf Hilferding (1877-1941)

Hilferding was the most original and important successor of Marx as a political economist. He was also a political leader of the German Social Democratic Party. Twice during the 1920s he served briefly as finance minister of Germany. His most important book is Finance Capital (1910). Whereas Marx’s Capital, based on mid-19th century Britain, treated capitalism as a competitive system with hundreds or thousands of firms per industry, Hilferding updated Marx’s analysis to consider the highly concentrated capitalism of the early 20th century. He used the term “finance capital” to refer to huge units of capital including groups of large industrial and commercial firms coordinated by financiers in huge conglomerates or “trusts.” Germany, Austria-Hungary and especially the U.S. provided the best examples of such immense concentrations of bank-centered capital. Leading Japanese capitalists soon imitated this form as well. Hilferding also described how large banks suppressed competition among firms in various industries by forming cartels to raise prices and restrict output, largely to prevent debtors from defaulting on loans during the various recessions that punctuated the deflationary period from the 1860s to the 1890s. Cartels and conglomerates required enhanced tariff protection to defend their higher prices from foreign competition. Thus the tendency toward freer trade was reversed in several major powers. Part Five of Hilferding’s book became the most influential. He described why these massive concentrations of capital led to a foreign policy of renewed imperialism, jingoism and arms races, leading to greater danger of war. One of the leaders of the Russian Bolshevik Party, Nikolai Bukharin, used his ideas as the basis of his pamphlet, Imperialism and the World Economy (1915), explaining the outbreak of World War I as a product of imperialist rivalries. Bukharin in turn influenced the foremost leader of the Bolshevik Revolution, V.I. Lenin, who wrote Imperialism, the Highest Stage of Capitalism (1917). Lenin’s book eventually became one of the most influential ever written on international relations. Yet the core of his ideas derive from Hilferding’s book, where they were expounded in richer detail. Finance Capital remains an important source for understanding the causes and impact of the centralization of capital. Tragically, both Bukharin and Hilferding were tortured and killed: Bukharin by order of Stalin in 1938 and Hilferding three years later by Hitler’s Nazis. Wikipedia

Hilferding was the most original and important successor of Marx as a political economist. He was also a political leader of the German Social Democratic Party. Twice during the 1920s he served briefly as finance minister of Germany. His most important book is Finance Capital (1910). Whereas Marx’s Capital, based on mid-19th century Britain, treated capitalism as a competitive system with hundreds or thousands of firms per industry, Hilferding updated Marx’s analysis to consider the highly concentrated capitalism of the early 20th century. He used the term “finance capital” to refer to huge units of capital including groups of large industrial and commercial firms coordinated by financiers in huge conglomerates or “trusts.” Germany, Austria-Hungary and especially the U.S. provided the best examples of such immense concentrations of bank-centered capital. Leading Japanese capitalists soon imitated this form as well. Hilferding also described how large banks suppressed competition among firms in various industries by forming cartels to raise prices and restrict output, largely to prevent debtors from defaulting on loans during the various recessions that punctuated the deflationary period from the 1860s to the 1890s. Cartels and conglomerates required enhanced tariff protection to defend their higher prices from foreign competition. Thus the tendency toward freer trade was reversed in several major powers. Part Five of Hilferding’s book became the most influential. He described why these massive concentrations of capital led to a foreign policy of renewed imperialism, jingoism and arms races, leading to greater danger of war. One of the leaders of the Russian Bolshevik Party, Nikolai Bukharin, used his ideas as the basis of his pamphlet, Imperialism and the World Economy (1915), explaining the outbreak of World War I as a product of imperialist rivalries. Bukharin in turn influenced the foremost leader of the Bolshevik Revolution, V.I. Lenin, who wrote Imperialism, the Highest Stage of Capitalism (1917). Lenin’s book eventually became one of the most influential ever written on international relations. Yet the core of his ideas derive from Hilferding’s book, where they were expounded in richer detail. Finance Capital remains an important source for understanding the causes and impact of the centralization of capital. Tragically, both Bukharin and Hilferding were tortured and killed: Bukharin by order of Stalin in 1938 and Hilferding three years later by Hitler’s Nazis. Wikipedia

William Stanley Jevons (1835-1882)

One of three (including Menger and Walras) leading founders of what is now often called neoclassical economics, to distinguish it from classical political economy of Smith through Mill and Marx. Neoclassical economics is the conceptual bedrock of modern textbook economics.

One of three (including Menger and Walras) leading founders of what is now often called neoclassical economics, to distinguish it from classical political economy of Smith through Mill and Marx. Neoclassical economics is the conceptual bedrock of modern textbook economics.

Unlike Menger and Walras, who treated consumer utility as a cardinal quantity of satisfaction, Jevons required only ordinal utility. His approach inspired the indifference curves subsequently described by Francis Edgeworth and taught in microeconomics courses to this day. Psychological research, logic, common sense, and business marketing practices all invalidate marginal utility as an actual description of consumer behavior. It is a convenient mathematical form for disseminating a specific wrong-headed philosophy of “rational” behavior that has endured so long only because of its mathematical convenience and its ideological power, justifying the facetious claim that so-called market economies are driven by the sovereign dispersed power of the consumers and not the concentrated power of corporate producers and financiers. In practice, Jevon’s approach justifies and obscures a plutocracy of wealth and corporate power. Jevons also introduced the wrong-headed notion that consumers discount the future in favor of the present. This becomes the justification for the interest rate. I will dispel this myth in a future blog. The flaw of Jevons’ approach, and all economics that follows him, is putting consumption logically prior to production, a reversal of the natural order of classical political economy. From this initial conceptual error, oceans of error follow. Wikipedia

John Maynard Keynes (1883-1946)

John Maynard Keynes (1883-1946)

Keynes is arguably the greatest political economist of the 20th century. His influence was enormous. He virtually founded macroeconomics as a distinct field of study. Yet only a portion of his important insights was received into the economic canon, and then only in a distorted and simplified form devised by John Hicks. Other of his important insights were lost on the mainstream but preserved by the post-Keynesian school, including Joan Robinson and Hyman Minsky. The most important of his views obscured by mainstream “Keynesianism” is a repudiation of the possibility of Walrasian general equilibrium. This is often called “disequilibrium economics.” I endorse this perspective, though on broader foundation than the post-Keynesians, in part because I also resurrect a neglected section of Keynes’ most neglected major work: A Treatise on Money. I independently discovered, then later found echoed in Keynes, the idea that instability in financial markets is a necessary consequence of the credit cycle and rival bear and bull investors. Keynes treatment of this was never popularized, in part because of his tortured exposition, but also because its implications of private strategic action so strongly undermined economists’ preference for deterministic mechanical economic models. Intentional private strategic action is contrary to the entire economic world view of what an economy is and does, although the orthodox do admit highly formalized strategic action in an isolated corner economics: duopoly theory using two-person games. They dare not generalize this sort of behavior the economy at large without undermining their entire system. Keynes original works remain a fruitful source of inspiration, although the textbook version of “Keynesianism” is merely a pale shadow of his originality. Wikipedia

Georg Friedrich List (1789-1846)

List was a German critic of the free-trade emphasis of classical British political economists such as Adam Smith and David Ricardo. He advocated tariffs to protect industry from foreign competition, especially during the early stages of industrial development in the face of formidable competitors, like Britain. He emphasized the nation as a whole rather than individual entrepreneurs or classes as the principal agent of development. Thus he referred to his as a “national system” of political economy. He lived part of his life in the U.S., where his protectionist ideas were also quite influential. Alexander Hamilton and his Federalist Party had already advocated tariff protection as a means to promote national economic development. Senator Henry Clay built on the ideas of Hamilton and List to propound what he called the “American system,” including not only tariff protection of industry, but also governmental support for canal, port, and railroad development. Clay was one of the foremost leaders and presidential candidates of the Whig Party, which by the 1850s disintegrated over slavery. Its main rival was the Democratic Party of Andrew Jackson. Major elements of the Whig Party were incorporated into the Republican Party, including its protectionist program. Methodologically, List could be considered as part of the German Historical School, which emphasized detailed empirical and historical studies as against the more abstract, speculative and theoretical direction that economics took under the later neoclassical theorists, including the Austrian School founded by Menger. Wikipedia

Alfred Marshall (1842-1924)

Alfred Marshall is the single most influential founder of the contemporary orthodox neoclassical school of economics. His textbook, Principles of Economics (1890), set the pattern for all succeeding textbooks. In fact, so little has changed since Marshall that his textbook could still be used to teach microeconomics. In most respects it is better written, more comprehensive and more carefully qualified than contemporary textbooks. Teaching of economics has largely degenerated since Marshall. He established the many short-cuts that remain staples of introductory economics to this day, including the ubiquitous supply-and-demand diagram and the tortured sense of time embodied in his concepts of the market-day, short-run and long-run, taught ever since. His segmented sense of time continues to bedevil economics, making it unable to conceive adequately commonplace situations where relative rates of change matter, such as may be expressed mathematically in systems of differential equations. Marshall’s neglect of money and credit until a half-hearted foray near the end of his life has also restricted the economic imagination ever since. Marshall built on the foundation of sand begun by Jevons, Menger and Walras: placing desire for consumption logically and textually prior to production and exchange in order to justify the economist’s conceit of consumer sovereignty. Ever since, economists have maintained that the motive force in the economy is weak and dispersed consumers rather than powerful and concentrated capitalists. Wikipedia

Alfred Marshall is the single most influential founder of the contemporary orthodox neoclassical school of economics. His textbook, Principles of Economics (1890), set the pattern for all succeeding textbooks. In fact, so little has changed since Marshall that his textbook could still be used to teach microeconomics. In most respects it is better written, more comprehensive and more carefully qualified than contemporary textbooks. Teaching of economics has largely degenerated since Marshall. He established the many short-cuts that remain staples of introductory economics to this day, including the ubiquitous supply-and-demand diagram and the tortured sense of time embodied in his concepts of the market-day, short-run and long-run, taught ever since. His segmented sense of time continues to bedevil economics, making it unable to conceive adequately commonplace situations where relative rates of change matter, such as may be expressed mathematically in systems of differential equations. Marshall’s neglect of money and credit until a half-hearted foray near the end of his life has also restricted the economic imagination ever since. Marshall built on the foundation of sand begun by Jevons, Menger and Walras: placing desire for consumption logically and textually prior to production and exchange in order to justify the economist’s conceit of consumer sovereignty. Ever since, economists have maintained that the motive force in the economy is weak and dispersed consumers rather than powerful and concentrated capitalists. Wikipedia

Karl Marx (1818-1883)

Marx and Mill represent two divergent tendencies at the culmination of classical political economy. Mill understood the role of financial capital better than Marx did, including the crucial influence of the expansion and contraction of credit. Marx discounted Mill and preferred to found his own system on Ricardo’s emphasis on physical capital. The Marx-Ricardo approach is useful if the focus is on the constraint of physical production on the total size of the pie to be distributed among classes, but their approach cannot produce an adequate theory of distribution or the rate of profit because it neglects the enormous and central role of financial capital at the strategic heart of capitalism. Marx saw finance as entirely parasitic, which in some sense it is because it grabs a share of physical output without producing anything, but his moral disdain led to strategic blunder when it came to formulating his masterwork, Capital. Ironically, Capital is not a comprehensive theory of capital because it neglects financial capital. It starts instead with the commodity form and then treats the physical process of production of commodities in order to demonstrate that the source of profit is the exploitation of workers. Even if you accept his conclusion, the way he reaches it through production alone obstructs what he claimed he also wanted to do, which is outline the “laws of motion” of capital. This is partly why he struggled endlessly to revise volumes 2 and 3 of Capital and could not finish either during his lifetime. (Both were eventually published by his friend Friedrich Engels who also added to Marx’s rough notes.) Marx got stuck in problems that are rooted in his conceptual scheme. His biggest obstacle was not the so-called “transformation problem” of values into prices, which obsessed his neoclassical critics, but an even more fundamental flaw that he also shares with those critics: the assumption that the rate of profit will tend to equalize across firms and industries. This ignores the impact of debt leverage on profits. Two firms, using the exact same physical capital, will have different rates of profit. The more leveraged bull will have a higher rate of profit than the stodgy bear that is self financed, assuming the typical case that the cost of borrowing is less than the profit rate of the firm. This is why dynamic political economy must be founded on the bear-bull distinction. This allows an endogenous explanation of the business cycle and integrates the strategies of individual firms with the macroeconomy. Wikipedia

Marx and Mill represent two divergent tendencies at the culmination of classical political economy. Mill understood the role of financial capital better than Marx did, including the crucial influence of the expansion and contraction of credit. Marx discounted Mill and preferred to found his own system on Ricardo’s emphasis on physical capital. The Marx-Ricardo approach is useful if the focus is on the constraint of physical production on the total size of the pie to be distributed among classes, but their approach cannot produce an adequate theory of distribution or the rate of profit because it neglects the enormous and central role of financial capital at the strategic heart of capitalism. Marx saw finance as entirely parasitic, which in some sense it is because it grabs a share of physical output without producing anything, but his moral disdain led to strategic blunder when it came to formulating his masterwork, Capital. Ironically, Capital is not a comprehensive theory of capital because it neglects financial capital. It starts instead with the commodity form and then treats the physical process of production of commodities in order to demonstrate that the source of profit is the exploitation of workers. Even if you accept his conclusion, the way he reaches it through production alone obstructs what he claimed he also wanted to do, which is outline the “laws of motion” of capital. This is partly why he struggled endlessly to revise volumes 2 and 3 of Capital and could not finish either during his lifetime. (Both were eventually published by his friend Friedrich Engels who also added to Marx’s rough notes.) Marx got stuck in problems that are rooted in his conceptual scheme. His biggest obstacle was not the so-called “transformation problem” of values into prices, which obsessed his neoclassical critics, but an even more fundamental flaw that he also shares with those critics: the assumption that the rate of profit will tend to equalize across firms and industries. This ignores the impact of debt leverage on profits. Two firms, using the exact same physical capital, will have different rates of profit. The more leveraged bull will have a higher rate of profit than the stodgy bear that is self financed, assuming the typical case that the cost of borrowing is less than the profit rate of the firm. This is why dynamic political economy must be founded on the bear-bull distinction. This allows an endogenous explanation of the business cycle and integrates the strategies of individual firms with the macroeconomy. Wikipedia

Carl Menger (1840-1921)

One of three (including Jevons and Walras) leading founders of what is now often called neoclassical economics, to distinguish it from classical political economy of Smith through Mill and Marx. Neoclassical economics is the conceptual bedrock of modern textbook economics.

One of three (including Jevons and Walras) leading founders of what is now often called neoclassical economics, to distinguish it from classical political economy of Smith through Mill and Marx. Neoclassical economics is the conceptual bedrock of modern textbook economics.

Menger is more readable than Walras for those allergic to mathematical presentations, but his perspective is similar. Along with Jevons, these founders of the contemporary neoclassical economic orthodoxy destroyed most of the insights of classical political economy by ignoring private power, treating consumption before production, and treating price as determined more by subjective consumer value rather than objective social cost, as in classical political economy. These massive errors would have been quickly corrected if economics were truly a science, rather than a speculative philosophy founded on false assumptions, but this approached survived and eventually thrived because it encouraged mathematical rigor, helping to disguise its inanity as descriptive science, and because it is fantastically useful as propaganda to obscure the power and strategic action of capitalists. Menger’s book, The Origins of Money, reinforces economists’ myths about money by ignoring the pervasive role of credit. He does get one thing right about money: it is a product of private business relations and not just governmental fiat, an insight that would be carried forward in the Austrian School of Economics founded by Menger. This school is enjoying an undeserved renaissance today, especially among libertarians. Wikipedia

John Stuart Mill (1806-1873)

Mill was an enormously influential British utilitarian philosopher and political economist. He represents the pinnacle of the classical school of political economy, along with the very divergent Marx. Mill’s principle advantage over Marx, and indeed, over the neoclassical economists who followed him, was his understanding of the influence of the expansion and contraction of credit on prices. Economists since Mill have tended to ignore credit and focus on the “money supply” instead (if indeed they do not ignore money prices altogether). This fatal error precludes the possibility of understanding dynamics of the business cycle. In the English-speaking world and beyond, Mill’s Principles of Political Economy (1848) was the most widely used textbook in economics until supplanted by the end of the 19th century by Marshall’s neoclassical work, Principles of Economics (1890). Among both neoclassical and Marxist economists, Mill tends to have a lower reputation than his predecessor, Ricardo, in part because Ricardo elaborates a more systematic and rigorous theory of value based on quantitative recipes of production. Sraffa built on this foundation in the 20th century. However, Ricardo is overly fixated on physical relations of production rather than understanding capitalism as a socio-financial system. Mill is better in this regard. Wikipedia

Mill was an enormously influential British utilitarian philosopher and political economist. He represents the pinnacle of the classical school of political economy, along with the very divergent Marx. Mill’s principle advantage over Marx, and indeed, over the neoclassical economists who followed him, was his understanding of the influence of the expansion and contraction of credit on prices. Economists since Mill have tended to ignore credit and focus on the “money supply” instead (if indeed they do not ignore money prices altogether). This fatal error precludes the possibility of understanding dynamics of the business cycle. In the English-speaking world and beyond, Mill’s Principles of Political Economy (1848) was the most widely used textbook in economics until supplanted by the end of the 19th century by Marshall’s neoclassical work, Principles of Economics (1890). Among both neoclassical and Marxist economists, Mill tends to have a lower reputation than his predecessor, Ricardo, in part because Ricardo elaborates a more systematic and rigorous theory of value based on quantitative recipes of production. Sraffa built on this foundation in the 20th century. However, Ricardo is overly fixated on physical relations of production rather than understanding capitalism as a socio-financial system. Mill is better in this regard. Wikipedia

Hyman Minsky (1919-1996)

Minsky is an important American economist much neglected during his lifetime. Yet posthumously his work has gained popularity, particularly during the aftermath of the 2008 global financial crisis. Minsky’s most important contribution is what he called the financial instability hypothesis. His views influenced my own, but I have come to see them as one-sided. Minsky explained how bankers and other financiers have an incentive to expand credit to arbitrarily high levels because they profit mainly as credit issuers. In my terminology, he has described the anatomy of the bull, but he ignores the bears. He does not understand that various financiers have both an incentive to expand credit and to limit it. Because the assets of many large creditors are primarily bonds and loans at fixed interest, excessive expansion of credit tends to create inflation, thereby devaluing creditors’ loan portfolios. Insofar as they can act collectively and strategically, they come to a point in the process of credit expansion, what Keynes called a culminating point, when further expansion of credit may so undermine the value of their existing portfolio by inflation that some financiers turn bearish and curtail credit. If the relative preponderance of the bears is sufficient, they create a self-fulfilling prophecy of tight credit and failing prices, which restores the relative value of money and debts. Minsky’s theory was one-sided because he never perceived this strategic bearish interest. Consequently his notion of financial instability could be compared to a lemming theory: financiers mindlessly drive credit expansion to ever-higher levels until debt payments become so unsustainable that a crash is inevitable. This is too rigidly deterministic, denying the strategic foresight actually exercised at the pinnacles of finance. Minsky’s financial instability thesis is correct, but because of the inevitable strategic competition between rival bears and bulls rather than any lemming-like fetish for self-destruction. Wikipedia

Minsky is an important American economist much neglected during his lifetime. Yet posthumously his work has gained popularity, particularly during the aftermath of the 2008 global financial crisis. Minsky’s most important contribution is what he called the financial instability hypothesis. His views influenced my own, but I have come to see them as one-sided. Minsky explained how bankers and other financiers have an incentive to expand credit to arbitrarily high levels because they profit mainly as credit issuers. In my terminology, he has described the anatomy of the bull, but he ignores the bears. He does not understand that various financiers have both an incentive to expand credit and to limit it. Because the assets of many large creditors are primarily bonds and loans at fixed interest, excessive expansion of credit tends to create inflation, thereby devaluing creditors’ loan portfolios. Insofar as they can act collectively and strategically, they come to a point in the process of credit expansion, what Keynes called a culminating point, when further expansion of credit may so undermine the value of their existing portfolio by inflation that some financiers turn bearish and curtail credit. If the relative preponderance of the bears is sufficient, they create a self-fulfilling prophecy of tight credit and failing prices, which restores the relative value of money and debts. Minsky’s theory was one-sided because he never perceived this strategic bearish interest. Consequently his notion of financial instability could be compared to a lemming theory: financiers mindlessly drive credit expansion to ever-higher levels until debt payments become so unsustainable that a crash is inevitable. This is too rigidly deterministic, denying the strategic foresight actually exercised at the pinnacles of finance. Minsky’s financial instability thesis is correct, but because of the inevitable strategic competition between rival bears and bulls rather than any lemming-like fetish for self-destruction. Wikipedia

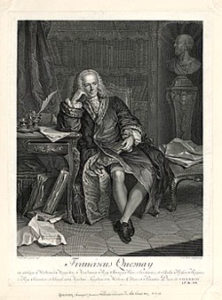

Francois Quesnay (1694-1774)

Quesnay, a French contemporary of Adam Smith, developed an economic table of inputs and outputs to production that bears some resemblance to modern neo-Ricardian input-output matrices such as used by Piero Sraffa and his successors. Like most classical political economists, his central problem was distinguishing between productive output and non-productive surplus expropriated as economic rents. He wanted to promote production by reducing tariffs and monopoly profits extracted at the expense of the direct producers. His broad aim was similar to Adam Smith’s, promoting growth by reducing barriers to trade, though his policy prescriptions differ since Quesnay appreciated less than Smith did the productive potential of industry. Smith criticized French thinkers like Quesnay, known as physiocrats, because they believed that all surplus value, and therefore growth, originates from the bounty of nature. Seed multiplies itself into much more grain and domestic animals produce more numerous offspring, even after deducting the costs of labor and tools used to tend them. Thinking of the world before the take-off into the industrial revolution, Quesnay did not envision, as Smith did, that the tools themselves could accumulate and concentrate in factories as more and more efficient physical capital. Wikipedia

Quesnay, a French contemporary of Adam Smith, developed an economic table of inputs and outputs to production that bears some resemblance to modern neo-Ricardian input-output matrices such as used by Piero Sraffa and his successors. Like most classical political economists, his central problem was distinguishing between productive output and non-productive surplus expropriated as economic rents. He wanted to promote production by reducing tariffs and monopoly profits extracted at the expense of the direct producers. His broad aim was similar to Adam Smith’s, promoting growth by reducing barriers to trade, though his policy prescriptions differ since Quesnay appreciated less than Smith did the productive potential of industry. Smith criticized French thinkers like Quesnay, known as physiocrats, because they believed that all surplus value, and therefore growth, originates from the bounty of nature. Seed multiplies itself into much more grain and domestic animals produce more numerous offspring, even after deducting the costs of labor and tools used to tend them. Thinking of the world before the take-off into the industrial revolution, Quesnay did not envision, as Smith did, that the tools themselves could accumulate and concentrate in factories as more and more efficient physical capital. Wikipedia

David Ricardo (1777-1823)

Ricardo had the good sense to apply the concept of marginal productivity only to his theory of rent, rejecting its application to labor and capital, but subsequently Jevons, Menger and Walras founded what is now often called “neoclassical” economics to distinguish from classical political economy that included Smith, Malthus, Ricardo, Mill and Marx. The biggest error in all of political economy was the neoclassical generalization of Ricardo’s theory of land rent to all so-called “factors of production,” including labor and capital. Ricardo recognized that labor and capital are often employed together in what he called “doses,” that is, fixed increments. His doses have two properties excluded by all versions of neoclassical marginal productivity up to and including modern general equilibrium theory: they are “lumpy” or discrete and they fix the proportion of labor to a particular unit of physical capital, such as a machine. A dose might be one worker tending one sewing machine. The worker plus sewing machine are a scalable single dose. A factory owner cannot add continuous small increments of capital, as in a smoothly differentiable continuous curve. Half a machine is not functional. Furthermore, it makes no make sense to add a second sewing machine without adding a worker to operate it. In such cases, neither labor nor capital have a distinct marginal physical product (MPP), since the definition of MPP of capital (or labor) is the increment by which output increases when adding one additional increment of capital while holding labor (or capital) constant. Although it is possible to define MPP in some instances, if it is not relevant to all combinations of labor and capital, as Ricardo correctly believed, then it is not possible to calculate the MPP of every factor of production. MPP cannot be the universal explanation for the quantity of factors employed in production nor the income (rent, profit or wage) each generates, though this is indeed the conceit of neoclassical economics. The entire edifice of modern economics falls on this point, though it is only one of numerous such fatal flaws. Needless to say, the managerial accounting actually used by firms to calculate profit and how to decide which investment projects are viable does not use these bedrock tools of economics. One could write an entire book just on the difference between how economists argue firms must act to maximize profits and how they actually keep accounts and make decisions. It is worlds apart. Wikipedia

Ricardo had the good sense to apply the concept of marginal productivity only to his theory of rent, rejecting its application to labor and capital, but subsequently Jevons, Menger and Walras founded what is now often called “neoclassical” economics to distinguish from classical political economy that included Smith, Malthus, Ricardo, Mill and Marx. The biggest error in all of political economy was the neoclassical generalization of Ricardo’s theory of land rent to all so-called “factors of production,” including labor and capital. Ricardo recognized that labor and capital are often employed together in what he called “doses,” that is, fixed increments. His doses have two properties excluded by all versions of neoclassical marginal productivity up to and including modern general equilibrium theory: they are “lumpy” or discrete and they fix the proportion of labor to a particular unit of physical capital, such as a machine. A dose might be one worker tending one sewing machine. The worker plus sewing machine are a scalable single dose. A factory owner cannot add continuous small increments of capital, as in a smoothly differentiable continuous curve. Half a machine is not functional. Furthermore, it makes no make sense to add a second sewing machine without adding a worker to operate it. In such cases, neither labor nor capital have a distinct marginal physical product (MPP), since the definition of MPP of capital (or labor) is the increment by which output increases when adding one additional increment of capital while holding labor (or capital) constant. Although it is possible to define MPP in some instances, if it is not relevant to all combinations of labor and capital, as Ricardo correctly believed, then it is not possible to calculate the MPP of every factor of production. MPP cannot be the universal explanation for the quantity of factors employed in production nor the income (rent, profit or wage) each generates, though this is indeed the conceit of neoclassical economics. The entire edifice of modern economics falls on this point, though it is only one of numerous such fatal flaws. Needless to say, the managerial accounting actually used by firms to calculate profit and how to decide which investment projects are viable does not use these bedrock tools of economics. One could write an entire book just on the difference between how economists argue firms must act to maximize profits and how they actually keep accounts and make decisions. It is worlds apart. Wikipedia

Joan Robinson (1903-1983)

Robinson is one of the founders of the post-Keynesian school of economics, which tries to preserve and extend the original insights of Keynes against the efforts of John Hicks and subsequent neoclassical economists to shoehorn a few of Keynes’ key ideas back into the neoclassical conceptual prison he tried to transcend. She was also an important innovator in her own right. Her book, The Economics of Imperfect Competition (1933) coined the term “monopsony” to refer to monopoly buyers. She argued that most markets exhibit a greater or lesser degree of economic power, which she used to explain the systematic wage discrimination against women, among other things. She laid the foundation for a general theory of economies that include market trading but also significant private power. She is one major inspiration for my own approach to political economy. Later she was one of the pioneers of economic development theory. She was allied with Piero Sraffa against Paul Samuelson and others during the very significant 1960s Cambridge capital controversy. Her short book, Economic Heresies, explains the importance of that controversy and is an excellent introduction to all that is wrong with textbook macroeconomics. She is one of the great political economists of the twentieth century, but because of her heterodox views, much of her work has been side-lined or taught only in caricature, like that of Keynes. Wikipedia

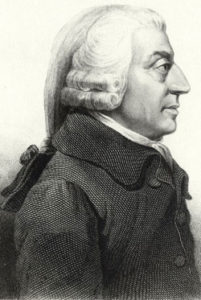

Adam Smith (1723-1790)

Smith is universally hailed as a precursor to nearly every theory of political economy. Yet he belongs firmly to the classical school. Much of what he argued runs contrary to the neoclassical economists that define today’s orthodoxy. Smith, like the entire classical school, sensibly starts with production, then distribution. Consumption takes last place. Likewise, his objective theory of value derives from cost of production rather than subjective consumer whims, as in the neoclassical view. Smith and the classical school were on the right track. Price is limited by the social reproducibility of products, i.e., their cost of production, plus the “bribes” required to secure the cooperation of owners of land and capital. If price falls below the social cost of production, production will decline or cease. If price rises above social cost, new producers will enter the market and produce until the price again falls to the social cost, unless an effective monopoly power can dissuade new entrants. Modern textbooks ignore the real Smith: he was vigorously opposed to large corporations (such as the British East India Company) and the chaos created by financial speculators. He believed private power struggles, not the “free market,” largely determined wage rates. In this he anticipated Joan Robinson. He believed in free competitive markets, but was also wary of the concentrated power of big business. This is not the side of Smith taught today. Wikipedia

Smith is universally hailed as a precursor to nearly every theory of political economy. Yet he belongs firmly to the classical school. Much of what he argued runs contrary to the neoclassical economists that define today’s orthodoxy. Smith, like the entire classical school, sensibly starts with production, then distribution. Consumption takes last place. Likewise, his objective theory of value derives from cost of production rather than subjective consumer whims, as in the neoclassical view. Smith and the classical school were on the right track. Price is limited by the social reproducibility of products, i.e., their cost of production, plus the “bribes” required to secure the cooperation of owners of land and capital. If price falls below the social cost of production, production will decline or cease. If price rises above social cost, new producers will enter the market and produce until the price again falls to the social cost, unless an effective monopoly power can dissuade new entrants. Modern textbooks ignore the real Smith: he was vigorously opposed to large corporations (such as the British East India Company) and the chaos created by financial speculators. He believed private power struggles, not the “free market,” largely determined wage rates. In this he anticipated Joan Robinson. He believed in free competitive markets, but was also wary of the concentrated power of big business. This is not the side of Smith taught today. Wikipedia

Piero Sraffa (1898-1983)

Sraffa is one of the most important theoretical economists of the 20th century, but because his challenges to neoclassical orthodoxy are so devastating, his work is little taught. His first key contribution to political economy is his 1926 refutation of Marshall’s theory of the competitive firm, which is nonetheless still taught in Marshall’s form as if Sraffa’s critique never existed. Whereas textbook economics since Marshall always teaches that the supply curve of a competitive firm has a positive slope, Sraffa shows deductively what factory managers know empirically: the supply curve of a typical firm must be flat or negatively sloped. However, since this deductive and empirical result undermines the Marshallian supply-and-demand analysis as well as Walrasian general equilibrium, orthodox economists simply ignore it. It cannot be refuted. Sraffa’s other great contribution came with the publication of his book, Production of Commodities by Means of Commodities (1960). This book founded what is called the neo-Ricardian school of economics. While I find it sterile as the foundation of an alternative to neoclassical economics, given its neglect of finance and credit, nonetheless Sraffa proved that the neoclassical definition of profit as a rate of return on a quantity of capital is circular. This proof undermines the entire neoclassical theory of distribution and its justification for profits. Sraffa conducted, along with Joan Robinson, a debate in print during the 1960s with Paul Samuelson, then among the foremost American economists and prolific textbook author. This dispute, called the Cambridge capital controversy, established that the neoclassical definition of quantity of physical capital was circular and nonsensical because the profit rate had to be specified before the quantity of capital could be measured, but then how could the profit rate also be determined by the quantity of capital thus measured if it were already known a priori? Samuelson had no logical rejoinder, but ultimately retreated into a vague, unworldly and unempirical definition of physical capital that persists until now in mainstream textbooks. Wikipedia

Sraffa is one of the most important theoretical economists of the 20th century, but because his challenges to neoclassical orthodoxy are so devastating, his work is little taught. His first key contribution to political economy is his 1926 refutation of Marshall’s theory of the competitive firm, which is nonetheless still taught in Marshall’s form as if Sraffa’s critique never existed. Whereas textbook economics since Marshall always teaches that the supply curve of a competitive firm has a positive slope, Sraffa shows deductively what factory managers know empirically: the supply curve of a typical firm must be flat or negatively sloped. However, since this deductive and empirical result undermines the Marshallian supply-and-demand analysis as well as Walrasian general equilibrium, orthodox economists simply ignore it. It cannot be refuted. Sraffa’s other great contribution came with the publication of his book, Production of Commodities by Means of Commodities (1960). This book founded what is called the neo-Ricardian school of economics. While I find it sterile as the foundation of an alternative to neoclassical economics, given its neglect of finance and credit, nonetheless Sraffa proved that the neoclassical definition of profit as a rate of return on a quantity of capital is circular. This proof undermines the entire neoclassical theory of distribution and its justification for profits. Sraffa conducted, along with Joan Robinson, a debate in print during the 1960s with Paul Samuelson, then among the foremost American economists and prolific textbook author. This dispute, called the Cambridge capital controversy, established that the neoclassical definition of quantity of physical capital was circular and nonsensical because the profit rate had to be specified before the quantity of capital could be measured, but then how could the profit rate also be determined by the quantity of capital thus measured if it were already known a priori? Samuelson had no logical rejoinder, but ultimately retreated into a vague, unworldly and unempirical definition of physical capital that persists until now in mainstream textbooks. Wikipedia

Leon Walras (1834-1910)

One of three (including Jevons and Menger) leading founders of what is now often called neoclassical economics, to distinguish it from classical political economy of Smith through Mill and Marx. Neoclassical economics is the conceptual bedrock of modern textbook economics.

One of three (including Jevons and Menger) leading founders of what is now often called neoclassical economics, to distinguish it from classical political economy of Smith through Mill and Marx. Neoclassical economics is the conceptual bedrock of modern textbook economics.

Walras is perhaps the most celebrated of the three founders of neoclassical economics today because he elaborated a mathematical theory of general equilibrium that supposedly proved that free market economies tend toward equilibrium of supply and demand in all markets. His formulation was summarized by “Walras’ Law” that excess supply and demand in an economy sum to zero. This proposition and a similar one formulated earlier called Say’s Law are mathematically convenient but obviously false in the real world. They are so obviously invalid that it is rather amazing they are still taught with seriousness today. This is a measure of economics’ departure from fidelity to the real world. At least four major factors invalidate Walras’ system: 1) real economies include powerful corporate interests able to dominate price setting, whereas Walras assumes there is no such power; 2) Real-world purchases are often made on credit, which expands and contracts independent of production thereby allowing aggregate demand to exceed supply or vice versa; and 3) Walras’ static method presumes all purchases and payments are made at an instant of time, whereas actual purchasing and payment streams are separated in time; furthermore means of payment (money, etc.) may be diverted into purchases of non-produced assets like existing real estate that can divert demand for new products away from equilibrium; 4) Walras never demonstrates that general equilibrium is a stable result; he merely assumes the result he wants by presuming no trades occur except at prices that equilibrate supply and demand. This is a tautology, not a proof. In fact, given any of the factors 1-3 that allow trades to occur at non-equilibrium prices, the Walrasian system disintegrates. It explains nothing about real-world economies. Wikipedia